Big brands are allocating small amounts of their advertising budget to Elon Musk’s X, seeking to avoid being seen as boycotting the social media platform and triggering a public fallout with its billionaire owner.

Multiple marketing executives told the Financial Times that companies have felt pressure to spend a nominal sum on X following Musk’s high-profile role in US President Donald Trump’s administration.

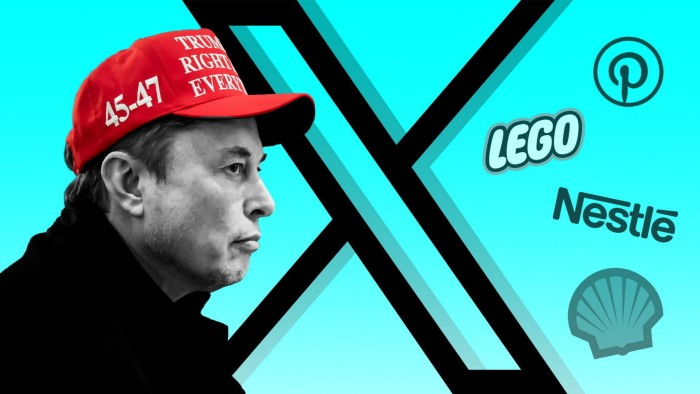

They said Musk’s pursuit of legal action against groups that have stopped advertising since his $44bn acquisition in late 2022 had also sparked alarm. X last month added about half a dozen more companies to its case including Shell, Nestlé, Pinterest and Lego.

“It’s whatever amount is enough to stay off the naughty list,” said Lou Paskalis, chief executive of marketing consultancy AJL Advisory and a former media executive at Bank of America.

“It’s not because the brand safety risk has gone away. But the far greater risk is that a comment [from Musk] in the press sends your stock price tumbling, and instead of a multimillion-dollar risk you’re facing a multibillion-dollar risk.”

The move comes as X was this week bought by Musk’s artificial intelligence group xAi in a deal that valued the social media platform at $45bn, including debt. Musk said that he would combine the data, models and talent of the two companies.

Investors have been buoyed by Musk’s proximity to the Trump administration as well as signs that his cost-cutting approach has been effective and revenues are improving.

Musk and X chief executive Linda Yaccarino have set a goal that aims to boost advertising revenues back to 2022 levels, according to two people familiar with the matter. They believe this is the minimum X should be bringing in without the hit caused by brands “boycotting” or avoiding the platform over its political bent, the people said.

According to data from Emarketer, X’s revenue will increase to $2.3bn this year compared with $1.9bn a year ago. However, global sales in 2022, when the group was known as Twitter and taken over by Musk, were $4.1bn.

Total US ad spend on X was down by 2 per cent in the first two months of 2025 compared with a year ago, according to data from market intelligence group Sensor Tower, despite the recent return of groups such as Hulu and Unilever.

American Express also rejoined the platform this year but its ad spend is down by about 80 per cent compared with the first quarter of 2022, Sensor Tower said.

However, four large ad agencies — WPP, Omnicom, Interpublic Group and Publicis — have recently agreed deals, or are in talks, to set annual spending targets with X in so-called “upfront deals”, where advertisers commit to purchasing slots in advance.

X, WPP, Omnicom and Publicis declined to comment. Interpublic Group did not respond to a request for comment.

Fears have risen within the advertising industry after X filed a federal antitrust lawsuit last summer against Global Alliance for Responsible Media, a coalition of brands, ad agencies and some companies including Unilever, accusing them of co-ordinating an “illegal boycott” under the guise of a brand safety initiative. The Republican-led House of Representatives Committee on the Judiciary has also levelled similar accusations.

Unilever was dropped from X’s lawsuit after it restarted advertising on the social media platform in October.

Following discussions with their legal team, some staff at WPP’s GroupM now feel concerned about what they put in writing about X or communicate over video conferencing given the lawsuit, according to one person familiar with the matter.

Another advertising executive noted that the planned $13bn merger between Omnicom and Interpublic had been delayed by a further request for information from a US watchdog this month, holding the threat of regulatory intervention over the deal.

Sensor Tower said that 35 of X’s top advertisers in 2025 did not advertise on the platform in 2023, which highlighted it “is attracting a new swath of advertisers”. These included Maga merchandise shop Rock Paper Sizzle, caffeine drinks brand Celsius and telehealth group Hims & Hers.

X insiders pointed to the increasing number of small brands using self-serve tools, as well as new artificial intelligence tools offered by X’s Grok chatbot to generate an ads campaign.

“They’ll get back there [to past levels of advertising revenue], it just won’t be the same mix of advertisers,” the person said.

Mark Penn, chief executive of New York-based agency Stagwell said X was “a revived and increasingly vibrant platform”.

He added: “The political boycotts and things are dissipating because companies are realising that taking one side and the other is a dangerous place to be.”

In documents obtained by the Financial Times, Omnicom Media Group told brands this year that X was a “compelling opportunity for our clients”, touting improvements in brand safety as well as its ads offering, particularly new video formats.

It also said potential return on investment was “at an all-time high”, in part because the agency had negotiated “the most favourable discounts” with the platform.

“The idea of a high return on investment is laughable,” said a rival media buyer. “You get what you pay for. If you want cheap, that is cheap media that you are getting”.

Ruben Schreurs, chief executive of Ebiquity, which measures how much money is being spent by brands on different platforms, said he did not “see an imminent return to prior scale in terms of ad budgets being flown through to X”.

But he added: “It will not surprise me, personally, if we at some point in the near future will see the president actually calling for brand advertisers to return to X.”