This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back to FirstFT Asia. On today’s agenda:

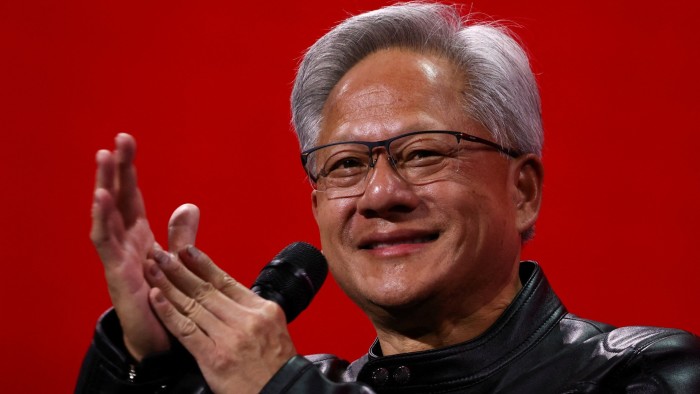

Nvidia plans to launch a new artificial intelligence chip designed specifically for China as soon as September, with chief executive Jensen Huang planning a visit to reassert the company’s commitment to the country. Here’s what we know about chipmakers plans.

About the chip: The chip is a version of Nvidia’s existing Blackwell RTX Pro 6000 processor modified to meet US President Donald Trump’s tightened export control rules. It would be stripped of the most advanced technologies, such as high-bandwidth memory and NVLink, which improves interconnections for faster data transfers.

Nvidia’s clients in China have been testing samples of the chip and expressed interest in significant orders, according to the two people with knowledge of the company’s plans. However, Chinese clients have grown concerned about the risk of relying too much on Nvidia products amid US policy uncertainties.

Huang’s China trip: Nvidia’s chief plans to meet top Chinese leaders as he attends the International Supply Chain Expo in Beijing starting next Wednesday, according to people familiar with his schedule. He is expected to reaffirm Nvidia’s commitment to the Chinese market in the face of multiple rounds of export restrictions.

$4tn market value: The chips group yesterday became the first company to hit a $4tn market capitalisation. Nvidia stock has risen by more than 40 per cent since early May, when Trump first signalled a thaw in his trade war with China and Nvidia struck a series of multibillion-dollar chip deals in the Middle East.

Read the full story about Nvidia’s China plans.

Here’s what else we’re keeping tabs on today:

-

Economic data: Malaysia reports May labour force statistics.

-

South Korea: The Bank of Korea announces its interest rate decision.

-

Results: Japanese companies Seven & i Holdings and Fast Retailing report results. Taiwan Semiconductor Manufacturing Company reports June sales.

Five more top stories

1. Trump said Brazil would be subject to US tariffs of 50 per cent on its goods, accusing the country of treating former president Jair Bolsonaro unfairly. Bolsonaro is on trial over an alleged coup plot, which prosecutors say aimed to keep him in power after losing an election in 2022. Here are more details.

2. Singapore’s state investor Temasek has become more bearish on European companies, just a year after opening a Paris office and promising to commit $19bn to the region. Rising trade tensions have made Temasek fearful that the European companies it has previously targeted for investment will be among the worst affected.

-

Revolut: The UK-based fintech is in talks to raise new funding from investors at a $65bn valuation, in a transaction that would fuel global expansion for Europe’s most valuable start-up.

3. Linda Yaccarino is stepping down as chief executive of X after two years in the role. The former NBCUniversal executive was tasked with bringing back advertisers who had pulled their spending over Musk’s decision to relax moderation on the platform as well as his own provocative and sometimes conspiracy-laced posts. Here are more details.

4. Boston Consulting Group has been ordered to explain its activities in Gaza to a UK parliamentary committee as pressure intensifies on the US consultancy. The FT reported last week that BCG had modelled the costs of relocating Palestinians from Gaza and had also entered into a multimillion-dollar contract to help launch an aid scheme for the shattered enclave. Read the full story.

5. The number of US measles infections has surged to the highest level since 1992, causing 162 hospitalisations and three deaths this year, according to new data. Since the start of the year, there have been 1,288 confirmed cases nationally though July 8 — about one-third of the cases have been in one west Texas county.

News in-depth

India has been a money machine for Jane Street, netting the trading giant more than $4bn in profits in just over two years. But it is now accused by the country’s stock market regulator of a “sinister scheme” to manipulate derivatives markets — a scandal that is imperilling the Wall Street firm’s golden run.

We’re also reading . . .

Chart of the day

Indonesia’s big bet on nickel is at risk of turning sour, as plunging prices and a supply crunch of ore force refiners to reduce output and lay off workers.

Take a break from the news

This Friday, join the FT’s books editors Frederick Studemann and Maria Crawford for a virtual Q&A to help you find the perfect summer books. Leave a comment below the story, telling Fred and Maria briefly about what you like to read, and they will mine nearly 30 categories of fiction and non-fiction to bring you a recommendation.