Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

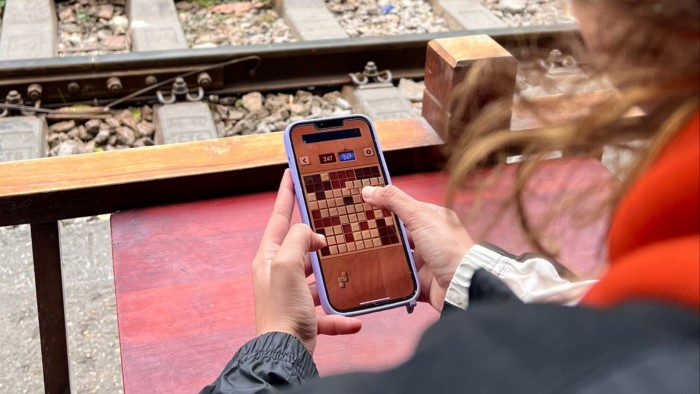

London-based games developer Tripledot Studios is acquiring AppLovin’s games business for $800mn, in a deal that will vault the creator of Woodoku and Solitaire.com into the rankings of the world’s largest independent mobile games companies.

US-based AppLovin, which is selling its games portfolio in order to focus on its core mobile advertising business, will take a $400mn stake in Tripledot as part of the deal, which is also funded through cash and debt. The deal values Tripledot at around $2bn.

Tripledot will acquire a portfolio of 10 studios, including titles such as Matchington Mansion and Game of War, that will take its annual total gross revenues — a measure of advertising income and players’ total in-app spending, before splits with distributors and other platform fees — to nearly $2bn. Its audience will more than double to more than 25mn daily active players.

That will place Tripledot, which was founded in 2017, alongside the likes of Dream Games, Moon Active and Playrix, among the world’s largest independent mobile games companies.

“We are moving from the Championship to the Premier League,” said Lior Shiff, Tripledot’s chief executive and co-founder.

The deal is the latest in a series of large investments and acquisitions in the mobile gaming market over the past few months, after Saudi-backed Scopely’s $3.5bn acquisition of Niantic games including Pokémon Go, as well as private equity group CVC’s investment in Dream Games, valuing the creator of Royal Match at close to $5bn.

The video games industry has faced a challenging period after the Covid-19 pandemic fuelled a surge in players and spending at the start of the decade. Thousands of games developers and other industry workers have been laid off in the last two years as companies adjust to a slower-growth era.

Even the mobile games business, which has piggybacked on expanding global smartphone ownership for more than 15 years, has struggled, as overcrowded app stores make it harder for new releases to break through.

According to Sensor Tower, a mobile market researcher, global mobile game downloads declined by 6 per cent last year to 49.6bn. The number of new releases reaching the top 1,000 mobile games in the US by downloads has fallen in recent years, Sensor Tower found, accounting for just over 10 per cent last year. That makes acquisitions of established games more attractive than taking the risk and high marketing cost of launching a brand new title.

Tripledot has managed to defy the industry trends, Shiff said, by generating most of its revenue via advertising in games and a diversified portfolio of titles. “Despite the headwinds in the industry, we managed to have a really good year last year,” he said, adding that the acquisition would be “transformational”.

Being a larger company will allow Tripledot to invest more in artificial intelligence to boost developer productivity and diversify its business model, with its revenue evenly split between advertising and players spending money in its games, for power-ups and other virtual items.

In the most recent accounts available through the UK’s Companies House registry, Tripledot reported $339.9mn in revenues for 2023, up 15 per cent on the previous year, with $51.6mn in pre-tax profit.

Adam Foroughi, AppLovin chief executive, said Tripledot’s team are “some of the best operators in the business”. While owning games studios helped train its AI models, “we’ve never been a game developer at heart”, he added.

AppLovin was one of Wall Street’s top performing tech stocks last year, driven by rapid growth in its AI-powered ad targeting business.

However, its shares have fallen by more than 40 per cent since mid-February after being hit by short seller reports, which alleged AppLovin exaggerated its ad targeting system’s capabilities and had inflated the value and scale of its network.

AppLovin has denied the allegations, saying the reports were “littered with inaccuracies and false assertions”, and has hired a law firm to investigate the short sellers’ activities.